We are an award winning product design consultancy, we design connected products and instruments for pioneering technology companies.

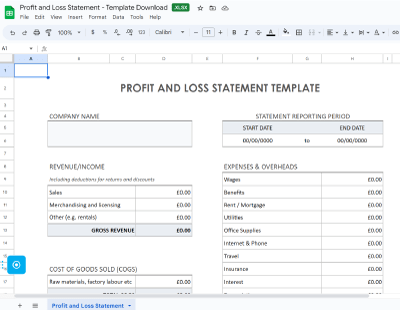

A free profit and loss template to help assess the health of your business

Reading time 5 mins

Key Points

- A Profit and Loss statement is essential financial documentation for all businesses

- It calculates net profit/loss over a defined period and helps to identify which areas are the most profitable, where inefficiencies can be improved, what the seasonal trends are, and how much it costs to produce the goods/services sold in relation to how much is earned

- Our simple profit and loss template provides an accurate overview of a business’s bottom line (i.e. are they making or losing money)

- This is one of the key documents that investors or banks will want to look at when deciding whether to provide a business with financial support

- It’s an essential tool that helps startups and entrepreneurs to develop their financial literacy and helps avoid the pitfall of overspending

Looking to revolutionise healthcare experiences with technology? We're here to design health tech solutions that can redefine care provision. Make contact now to find out more.

Ben Mazur

Managing Director

I hope you enjoy reading this post.

If you would like us to develop your next product for you, click here

In our last template post, we provided a tool for new businesses to calculate startup costs to avoid running out of cash before earning enough revenue to become self-sustainable. Download our free profit and loss template if your company has started earning revenue to help you asses its financial health and answer one crucial question: are you making money or losing it?

Also known as an income statement or P & L, a profit and loss statement is one of the three financial documents that every business must have – a balance sheet and a cash flow statement being the other two.

Profit and loss

Profit and loss

Download our free template

Suggested articles

A business startup costs template to help set you up for success

How to find investors for your product idea

Developing a financial plan for investment that inspires confidence

Why every startup should have a P&L statement

While angel investors and crowdfunding supporters might be willing and able to financially support a product idea with much potential, banks and business investors will want to see your business’s total income, debt and financial stability first – and decide whether they will finance it accordingly.

A P&L statement is a valuable tool for monitoring business activity as it calculates net profit and loss over a specific period and identifies:

- Where a business is succeeding, which parts are the most profitable, and how to maintain them

- Inefficiencies (i.e. losses) and potential improvements

- Seasonal trends

- The demand for a product/service against the costs incurred to provide it

- The return on investment investors are likely to get

How to use our profit and loss template

Most tax and accounting software will be able to calculate this for you, but if you’d like to have a simple version for a quick overview or investment pitch deck purposes, download our profit and loss template and get started by filling in the required fields. Diligent record keeping (e.g., receipts, invoices, payments) is essential to ensuring that your P&L is accurate. Once the necessary values have been added to the statement, the figures that explain profitability will be calculated for you. This includes:

- Gross Profit: an indicator of overall production efficiency and a key figure for setting prices and sales targets.

- Total Expenses: This shows what your operational costs are and indicates where you could cut down on losses

- Net Profit/Loss: Also known as the ‘bottom line’ as it gives the total amount earned or lost after all expenses have been paid

While this template will help give you an accurate overview of your business’s financial health, getting your accounts in order is crucial. If you don’t have a professional accountant on your team, consulting with one is always a good idea to ensure you’ve gotten everything right.

Did you find this financial template useful?

We hope so. Developing a financial plan that inspires confidence helps to avoid overspending and can also be used as a red flag that signals when something is going wrong – offering you an opportunity to address issues before it’s too late. In addition, investors find business owners’ financial literacy attractive as it assures them that their money will be invested in good hands.

We will be adding more free templates for financial documents that all businesses and startups should have, so if you haven’t already subscribed to our newsletter, please do so!

Comments

Get the print version

Download a PDF version of our article for easier offline reading and sharing with coworkers.

0 Comments