We are an award winning product design consultancy, we design connected products and instruments for pioneering technology companies.

Your money, your future: IoT-based personal finance solutions for security and freedom

Reading time 15 mins

Key Points

- Approximately 22.8 million people in the UK have little – to no – financial safety net. Economic pressures such as inflation and a high cost of living make saving even harder, triggering mental health problems caused by factors such as stress and anxiety.

- While the digital age has offered unprecedented access to financial tools and information, it has also created a landscape detrimental to financial well-being. For example, a lack of financial literacy, information overload, decision fatigue, and online shopping make compulsive spending dangerously easy.

- IoT holds the potential to alleviate these challenges by providing smarter, more secure, and accessible financial solutions. For example, connected wearables and devices sync with banking apps to monitor spending patterns in real time, categorise expenses, and issue alerts when users approach their budget limits or make purchases that deviate from a set plan.

- The global FinTech market size is forecast to rise from $340.10 billion in 2024 to $1152.06 billion by 2032, highlighting the increasing demand for personal finance solutions.

- For innovators and product developers looking to consolidate their place on the market, standing out will require more than functionality and convenience. It will require solutions that empower users to track spending, create budgets, save smarter, and make informed investment decisions.

- The future of personal finance enhanced by IoT will be seamless, personalised and integrated with additional technologies (e.g. AI, blockchain) for increased functionality, security, and support.

If your business wants to lead in the growing UK space sector, Ignitec offers the expertise, tools, and commitment to bring your vision to life.

Ben Mazur

Managing Director

I hope you enjoy reading this post.

If you would like us to develop your next product for you, click here

Did you know that over a third of Brits (34%) have either no savings or less than £1,000 in their savings accounts? That’s approximately 22.8 million people with little to no financial safety net. With economic pressures like rising inflation and soaring living costs, saving money has become an uphill battle for many – and the subsequent impact this has on mental health is considerable (e.g., increased stress, anxiety, and depression). But as digital technologies revolutionise industries from education to healthcare, the Internet of Things (IoT) is emerging as a transformative force in personal finance. Could IoT-based personal finance solutions be the key to achieving financial security and freedom?

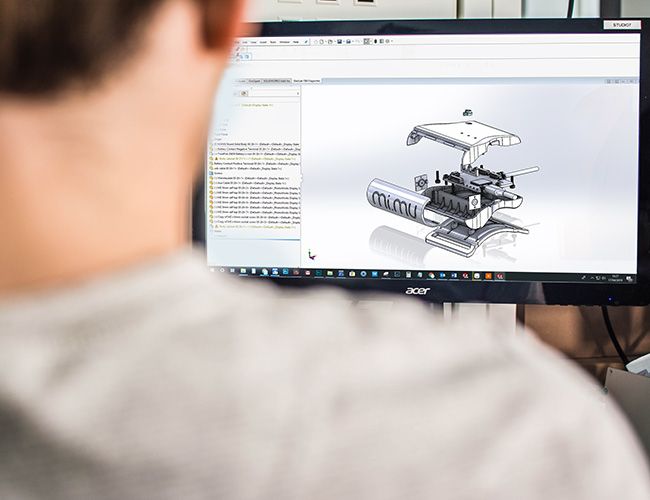

At Ignitec, we specialise in turning innovative ideas into tangible products. From early-stage design and user-centered R&D to secure software development and cutting-edge hardware design, we guide you through bringing your IoT-based personal finance solution to life. With our expertise in prototyping, electronic design, and low-volume manufacturing, we help transform your vision into a market-ready product that enhances financial security and drives future growth. Ready to make your IoT product a reality? Let’s collaborate and ignite the future of personal finance together.

Related services

Software Design Service for Data-Intensive Industries

Innovative Electronic Design Services, From Concept to Production

Driving Innovation with Ignitec’s Research and Development Services

Top 10 financial security pain points in the digital age

The digital age has largely transformed how we live, work, and manage money, offering unprecedented access to financial tools and information. Yet, it has also introduced significant complexities and challenges. The rapid pace of technological advancements, combined with the sheer volume of online resources, has created a landscape that can be overwhelming and, at times, even detrimental to financial well-being.

- Unpredictable Expenses: From rising costs of living to emergency expenses, financial unpredictability leaves many struggling to budget effectively.

- Lack of Financial Literacy: Many individuals lack access to tools or education to manage finances effectively, leading to poor saving and investment habits.

- Inefficient Tracking and Oversight: Traditional tools often fail to provide real-time insights into spending and saving, leaving gaps in financial awareness.

- Information Overload and Decision Fatigue: The Internet is flooded with financial advice, budgeting tools, and investment options. While helpful, the abundance of choices can lead to decision fatigue, making it harder to determine the best course of action for personal finances.

- Cybersecurity Threats and Fraud: As digital banking and payments become the norm, the risk of phishing attacks, identity theft, and fraud grows. These threats can severely impact financial stability and create significant stress for individuals trying to protect their personal information.

- The Temptation of Instant Gratification: Online shopping, fueled by social media and pervasive advertising, makes impulse spending dangerously easy. This culture of instant gratification often leads to overspending and financial strain, further compounding insecurity.

- The Rise of Fintech and Complexity: While fintech apps and services provide innovative solutions for managing finances, their sheer variety and complexity can be overwhelming, especially for those who lack technological literacy or understanding.

- Privacy Concerns and Data Security: The growing reliance on digital financial tools means more personal data is stored online. Data breaches and privacy violations pose serious risks, requiring constant vigilance to safeguard sensitive information.

- The Digital Divide: Not everyone can access digital tools and resources equally. Those on the wrong side of the digital divide often face significant disadvantages in managing their finances, limiting access to essential services and opportunities.

- Lack of Personalised Financial Insights: While many digital tools offer general guidance, only some provide tailored advice that aligns with an individual’s unique financial circumstances, goals, or challenges. This lack of personalisation can result in ineffective strategies that fail to address specific needs, leaving users feeling unsupported and uncertain about their financial future.

IoT holds the potential to alleviate these challenges by providing smarter, more secure, and accessible financial solutions.

IoT-based personal finance solutions for budgeting and investment

The Internet of Things (IoT) refers to a network of interconnected devices that communicate and share data through the Internet. From smart watches to energy-efficient appliances, IoT devices collect real-time data that can empower individuals to make smarter financial decisions. By integrating these devices into personal finance management, users can access more accurate insights into their spending habits, energy consumption, and investment opportunities. This leads to better budgeting, reduced waste, and more informed financial growth.

For businesses looking to innovate in this space, the development of IoT-enabled solutions offers the potential to redefine how users interact with their finances, fostering convenience, security, and precision.

1. IoT-enabled expense tracking and budgeting tools

IoT-connected wearables, such as smartwatches and fitness trackers, are evolving to include financial tracking features. These devices can sync with banking apps to monitor real-time spending patterns, categorise expenses, and issue alerts when you approach your budget limits. By providing immediate feedback, IoT-enabled wearables help you foster financial discipline and stick to your goals.

Example: A smart wallet with embedded IoT sensors can detect and sync transactions with a budgeting app. These wallets update you on their spending limits and provide tailored savings tips or alerts if spending habits deviate from the set plan.

Businesses interested in developing IoT-connected financial wearables can leverage our expertise at Ignitec to create cutting-edge products that merge functionality, comfort, and innovation. We specialise in turning ideas into reality, from sensor integration to app connectivity. Contact us for a quote.

2. Personalised investment insights

IoT and AI technologies are transforming how individuals manage their investments. IoT-powered devices collect real-time financial data and combine it with market insights to offer tailored recommendations for building wealth. With constant data flow, these systems can dynamically adjust investment strategies, ensuring they remain aligned with the user’s evolving financial goals.

Example: IoT-powered robo-advisors monitor individual financial objectives and analyse real-time market trends. They provide proactive suggestions, such as rebalancing portfolios or identifying undervalued assets, to maximise returns.

Are you looking to develop intelligent IoT-based investment solutions? Ignitec can help design AI-integrated devices that provide seamless user experiences, ensuring your product stands out in the competitive fintech market. Call us for a free consultation with an expert on our team!

3. Smart Home Devices for Cost Efficiency

IoT-enabled devices in the home enhance convenience and improve financial well-being. Smart thermostats, energy monitors, and water-saving systems track resource usage and provide actionable insights for reducing utility costs. Over time, these savings contribute to improved financial security and sustainability.

Example: A smart thermostat can analyse heating and cooling patterns, suggesting ways to reduce energy consumption without sacrificing comfort. Over time, such tools lead to significant savings, especially during peak usage.

Ignitec’s industrial design and prototyping expertise can bring your IoT-enabled smart home innovations to market. From energy monitoring solutions to custom hardware, we deliver functional, reliable, and user-centric products. Take a look at the award-winning smart thermostat we helped design!

FinTech market trends: Secure transactions, financial wellness, and digital banking

As people strive for greater control and clarity over their financial lives, the demand for personal finance solutions is increasing. The global FinTech market size is forecast to rise from $340.10 billion in 2024 to $1152.06 billion by 2032 – highlighting that as the market grows, standing out will require more than just functionality and convenience. It will require solutions that empower users to track spending, create budgets, save smarter, and make informed investment decisions while anticipating their needs and keeping transactions secure.

This will include:

- Biometric Authentication for Secure Transactions: IoT devices like fingerprint or facial recognition tools ensure secure banking experiences.

- Financial Wellness Apps: IoT-powered apps help users build better habits by gamifying saving or offering real-time coaching.

- Seamless Digital Banking: IoT enhances neobanks and digital wallets by enabling features like proximity payments, voice commands, and automated alerts.

- Automated Savings Programs: IoT-enabled apps can automatically transfer a portion of income or spare change into savings accounts based on user-defined goals, making saving easier without conscious effort.

- Smart Budgeting Tools: Leveraging IoT sensors and connected devices, these tools track and categorise spending in real time, providing actionable insights and recommendations to stay within budget.

- Real-time expenditure shadowing: IoT systems monitor spending as it happens, offering instant notifications and visual breakdowns of purchases, helping users make on-the-spot decisions to curb unnecessary expenses.

Challenges and Opportunities in IoT for Personal Finance

The integration of IoT in personal finance presents significant challenges, particularly concerning data privacy and security. As IoT devices collect and process more financial data, the risk of data breaches and misuse of sensitive information becomes a critical concern. Additionally, interoperability issues between IoT devices and existing financial systems hinder seamless integration, making it difficult for users to benefit from these technologies fully. Adoption barriers, particularly in developing regions and the Global South, with limited access to IoT infrastructure, further slow down widespread use.

On the flip side, IoT offers substantial opportunities for the financial sector. IoT enhances user engagement by enabling hyper-personalised financial products and tailoring services to individual needs and preferences. For both fintech startups and traditional financial institutions, IoT-powered solutions create new revenue streams, fostering innovation in the industry. Moreover, IoT has the potential to bridge financial inclusion gaps, providing underserved populations with innovative and accessible financial services.

What does the future for personal finance enhanced by IoT look like?

The future of personal finance enhanced by IoT is poised to be more seamless, intelligent, and personalised than ever before. As IoT devices become more integrated into everyday life, individuals will be empowered to make smarter financial decisions with real-time, data-driven insights.

- AI-Powered Predictions: IoT will integrate with AI to anticipate financial needs and suggest proactive solutions.

- Blockchain Integration: IoT devices may soon work seamlessly with blockchain technology for unparalleled transaction transparency and security.

- Ubiquitous Financial Assistants: Virtual assistants embedded in everyday devices could revolutionise how we interact with our finances, offering 24/7 support.

- Data-Driven Financial Health Monitoring: IoT-powered apps and wearables will serve as personal financial health monitors, continuously tracking financial habits, credit scores, and net worth. These devices will act like fitness trackers for money, helping individuals stay on track with their financial goals while providing guidance on improving their economic well-being.

In addition, the seamless integration of IoT in financial management could help individuals regain a sense of control, reducing the emotional burden of financial uncertainty and improving overall mental well-being.

Final thoughts

The fusion of IoT-based personal finance tools presents immense potential to address financial insecurity and empower people to take control of their economic future. By developing innovative IoT-based solutions, innovators and solution-driven companies have an unparalleled opportunity to lead the charge toward financial freedom for millions.

If you’re ready to build cutting-edge IoT technologies that transform personal finance into a force for freedom, our team is here to help. Let’s collaborate to create the future of financial empowerment together!

Suggested reading

Benefits of blockchain technology for product resilience and robust supply chains

Dive into the lucrative market of smart home IoT & maximise your profit potential!

Optimise consumer engagement with AI-enabled IoT products

FAQ’s

Why is IoT important for personal finance?

IoT is crucial for personal finance, enabling real-time tracking and monitoring of spending and saving habits. It lets users gain immediate insights into their financial behaviour and make data-driven decisions. With IoT, individuals can improve budgeting, optimise savings, and manage investments.

How can IoT help with budgeting?

IoT helps with budgeting by offering smart devices that track and categorise expenses automatically. It can send alerts when users are nearing their budget limits, helping them stay on track. These tools make it easier to stick to financial goals by providing instant feedback and recommendations for adjustments.

What are the benefits of IoT in personal finance?

IoT in personal finance offers numerous benefits, including smarter expense tracking, enhanced security, and more personalised financial insights. Users can gain a comprehensive overview of their financial situation by integrating various devices. These technologies empower individuals to make more informed and proactive financial decisions.

When will IoT be widely adopted in personal finance?

IoT adoption in personal finance is steadily increasing as more smart devices become available. However, widespread adoption will likely take a few more years as infrastructure and consumer awareness continue to grow. As IoT technology becomes more integrated into everyday life, its use in personal finance will become more mainstream.

Which devices are used in IoT-based personal finance?

Devices used in IoT-based personal finance include smart wallets, wearables, home assistants, and smart thermostats. These devices help users track spending, optimise energy costs, and easily manage financial tasks. As IoT technology develops, more devices will continue to be introduced to enhance financial management.

How can IoT help with saving money?

IoT helps save money by automating savings programs and providing users with real-time data on their financial habits. Smart devices, like energy-efficient appliances and smart thermostats, help reduce household costs. IoT-powered financial apps can also suggest personalised savings goals based on spending patterns.

What is the role of AI in IoT-based personal finance?

AI in IoT-based personal finance plays a significant role in analysing financial data and predicting future trends. It can provide users with proactive insights, such as recommending adjustments to their budget or suggesting investment opportunities. This combination of AI and IoT makes managing personal finances more intuitive and precise.

Why is security important in IoT-based personal finance?

Security is essential in IoT-based personal finance to protect sensitive financial data from cyber threats. As more financial information is collected and stored digitally, there is an increased risk of data breaches and fraud. Strong encryption, multi-factor authentication, and secure devices ensure users’ financial data remains safe.

What are the risks of IoT in personal finance?

The primary risks of IoT in personal finance include potential data breaches, cybersecurity threats, and device malfunction. Improperly secured devices can expose users’ personal information, leading to identity theft or fraud. Furthermore, the reliance on interconnected devices means that a single breach could compromise multiple aspects of a user’s financial data.

Who benefits from IoT-based personal finance?

IoT-based personal finance benefits a wide range of individuals, from those seeking better budget management to those looking for advanced investment tools. It is especially useful for people who want to automate their finances or track their spending in real time. Additionally, people with limited financial literacy can benefit from the ease and guidance IoT-enabled financial apps provide.

What types of personal finance apps use IoT technology?

Personal finance apps that use IoT technology include expense tracking, investment management, and savings automation. These apps integrate with IoT devices like wearables and smart home devices to gather data on spending habits. IoT allows these apps to offer more personalised recommendations and proactive financial insights.

How does IoT improve financial decision-making?

IoT improves financial decision-making by giving users real-time, actionable insights into spending, saving, and investment habits. The data collected from connected devices helps users make informed decisions based on their current financial behaviour. With more accurate and up-to-date information, individuals are better equipped to optimise their financial goals.

What are IoT-powered robo-advisors?

IoT-powered robo-advisors are automated financial platforms that use IoT data and AI to offer investment advice. These platforms monitor users’ financial goals and behaviours, adjusting portfolios accordingly. By integrating IoT, robo-advisors can provide highly personalised financial advice that evolves with a user’s needs.

Which IoT devices are best for managing finances?

The best IoT devices for managing finances include smart wallets, wearable devices, and smart home technology. Smart wallets can track spending, while wearables monitor habits like daily expenditure and health-related savings. Smart home devices, such as energy-efficient thermostats, can also help users reduce unnecessary costs, contributing to better financial management.

How does IoT-based financial tracking work?

IoT-based financial tracking collects data from connected devices like wearables and smart wallets. These devices monitor spending habits and categorise expenses automatically, providing users with up-to-date financial information. The integration of IoT allows for accurate, real-time tracking that is continuously updated, helping users stay on top of their finances.

What is the future of IoT in personal finance?

The future of IoT in personal finance will see more sophisticated, data-driven tools that offer hyper-personalised financial advice and automated decision-making. As devices become more interconnected, individuals will be able to manage their finances seamlessly, from budgeting to investing. AI and blockchain integration will also enhance security and transparency in financial transactions.

How can IoT help reduce energy costs?

IoT helps reduce energy costs by using smart home devices like thermostats and energy monitors that optimise energy use. These devices adjust settings automatically to reduce energy consumption and lower utility bills. The data collected allows users to track their energy usage and make informed decisions on cost-saving measures.

What is the role of wearables in personal finance?

Wearables play a role in personal finance by tracking spending habits and health-related financial goals and providing insights into daily expenditures. Devices like smartwatches can connect to budgeting apps and notify users about their financial progress in real time. Wearables make integrating financial tracking into daily routines easier, helping users maintain financial discipline.

When will IoT devices for personal finance become mainstream?

IoT devices for personal finance are becoming more mainstream as the technology matures and consumer demand grows. As more people adopt smart home devices and wearable technologies, the integration of IoT in financial management will continue to increase. Widespread adoption will likely happen over the next few years as these devices become more affordable and accessible.

What is the role of blockchain in IoT-based personal finance?

Blockchain plays a significant role in IoT-based personal finance by ensuring secure and transparent transactions. By integrating blockchain, IoT devices can provide an immutable ledger of financial transactions, reducing the risk of fraud. This technology enhances trust and transparency in economic processes, offering users greater security and confidence in their financial data.

Get a quote now

Ready to discuss your challenge and find out how we can help? Our rapid, all-in-one solution is here to help with all of your electronic design, software and mechanical design challenges. Get in touch with us now for a free quotation.

Comments

Get the print version

Download a PDF version of our article for easier offline reading and sharing with coworkers.

0 Comments